June 1st, 2023

Deal Newsletter

Buy-side Mandate: An India based Agricultural Chemicals company is looking to acquire 600-700 Cr in Pharma industry manufacturing Atorvastatin, Rosuvastatin, UDCA. Hot Deals

A Chemicals, Petrochems, and Fertilizers entity seeks strategic investment opportunities in India's thriving pharmaceutical industry. Invest in the API boom with a target engaged in the dynamic world of active pharmaceutical ingredients like - Atorvastatin, Rosuvastatin, UDCA.

Read moreBuy-side Mandate: An India based Infra company is looking to invest upto 1000 Cr in companies manufacturing building materials products like Doors, AAC, RMC.

Unleash India's Infrastructure Potential! Join hands with an innovative Indian Building Material Giant seeking strategic investments. Explore a diverse range of high-quality products including steel framing, RMC, doors, AAC, aggregates, construction chemicals, electrical systems, tiles, paints, gypsum board, artificial flooring, PVC pipes, plywood, laminates, MDF, and particle board.

Read moreBuy-side Mandate: An India based company is looking to acquire FMCG/Regional brands between 100-150 Cr manufacturing packaged foods, ice-cream, millets etc.

A strategic partnership opportunity. We're seeking FMCG products and local/regional brands in the processed food sector. If you offer packaged food, breakfast cereals, healthy snacking, millets, energy bars, or protein bars made from millets, we want to hear from you! We're particularly interested in vegan and sugar-free ice cream options.

Read moreBuy-side Mandate: An India based company is looking to acquire F&B companies between 500-150 Cr manufacturing coffee, tea extracts etc.

Seeking strategic investments in the booming food processing sector. From aromatic coffee to tantalizing shrimp, frozen treats to nutritious soya protein, explore a wide range of manufacturing plants.

Read moreSell-side Mandate: A North-India based Healthcare(Hospital) is looking for a sellout having 75 beds and area of 1200 sq yard.

Grab the Opportunity: 75-Bed Hospital in Northern India, Ready for Plug and Play! Fully constructed with top-notch facilities, including NICU beds and a centrally air-conditioned environment. Ideal for women and child care, or any specialty of your choice. Don't miss out on this deal!

Read moreSell-side Mandate: A North Central India based Facility management services is looking for a sellout having 20-25% EBITDA margins.

Acquire a Facility Management Company in India! This top-notch entity specializes in club management and facility services, catering to residential and commercial complexes. With a strong presence in North Central India, the company generates impressive monthly revenues of INR 2 Crores, with additional contracts under signing. Boasting EBITDA margins of 20%-25%, this profitable venture is ready to be yours. Don't miss out on this exceptional deal!

Read moreSell-side Mandate: An India based speciality chemicals company is looking for a sellout manufacturing bleach with 32% EBITDA.

Unleash the Power of Bleaching Earth! Invest in an Indian Specialty Chemicals Manufacturer with a Strong Export Market Presence and Competitive Advantage in Edible Oil Refineries. Kosher and Halal Certified.

Read more

MergerDomo is an online M&A platform that assists in identifying buy-side, sell-side, fundraising counterparties. With over 700+ registered Investment Bankers/consultants, 270+ Investors & 1500+ Corporates, we are uniquely placed to showcase M&A deals to a large & relevant audience. There are 120+ M&A live deals on our platform across different industries with ticket size ranging from INR 25 - 1000 crores. With over 2,300+ users, our platform aims to catalyse growth of the Corporate ecosystem through a suite of solutions in M&A, Fundraising (Debt/Equity) and consulting there off.

Key Service offerings:

- M&A/ Divestiture opportunities

- Strategic Equity and Debt Financing

- Consulting for the above Process

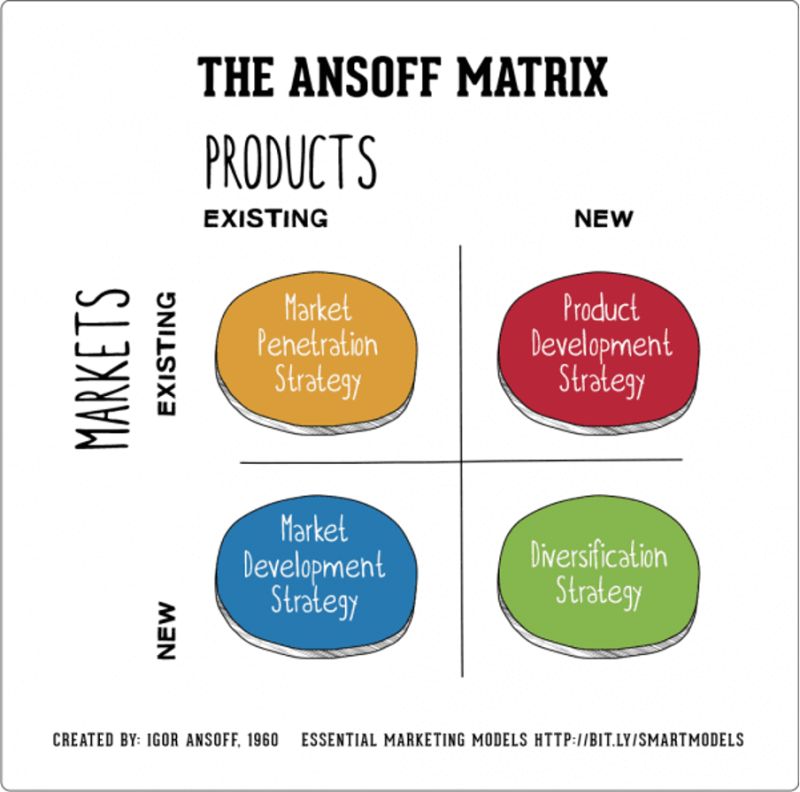

4 M&A strategies

A quick search on the net throws up many reasons for M&A (Horizontal/Vertical) including bringing economies of scale, operational efficiencies, tax benefits. While being a marketing model, We find the Ansoff’s matrix be a good guiding beacon on when may one explore taking the inorganic route:

1. Market penetration strategy – Buying out competition in ones existing market. This gives an opportunity to gain a larger market share via consolidation. One could do this via organic route too but that entails a deep pocket for getting customers attention (marketing muscle). Will the buyer keep the brand being bought out (yes if it has a strong national/regional presence) or kill it (what Ola did to Taxi for Sure to eliminate competition) as it may only want the customer base (loyalty would surely be known beforehand). Getting control of target’s supply chain could also be a potential reason.

2. Product development/extension strategy – offering complementary products (to your current ones) to your existing set of customers. Increases wallet share per customer. Makes immense sense as one doesn’t have to cannibalise either of the products. Tyring to do this the organic way would take considerable time and money for product R&D and market penetration. E.g Pepsi’s acquisition of Pizzahut.

3. Market development strategy – venturing into geographical expansion to sell existing product in new markets. Wisdom says one should do this after it has