MeitY Startup Hub onboards MergerDomo to strengthen start-up ecosystem in India

2022 has been an amazing year for MergerDomo as well as for deal making in India. M&A deal value in India rose to $152 Bn ($112 Bn) with transactions like Adani and Holcim, PVR – INOX mega merger and acquisition of Bisleri and Air India by TATA group. Large corporates remained active including Dabur's acquisition of Badshah Masala on which we rolled out our case study recently.

With RBI forecasting a 6.8% growth rate for 2022-23, we expect heightened M&A given strong macroeconomic indicators - increasing domestic consumption, digital penetration and infrastructure push along with China + 1 sentiment. With India becoming one of favoured investment destination (with liberal FDI policies) key sectors to look out are Electronics, Renewables, Defence. Dampeners could be another Covid outbreak, prolonged Ukraine war and high interest rates.

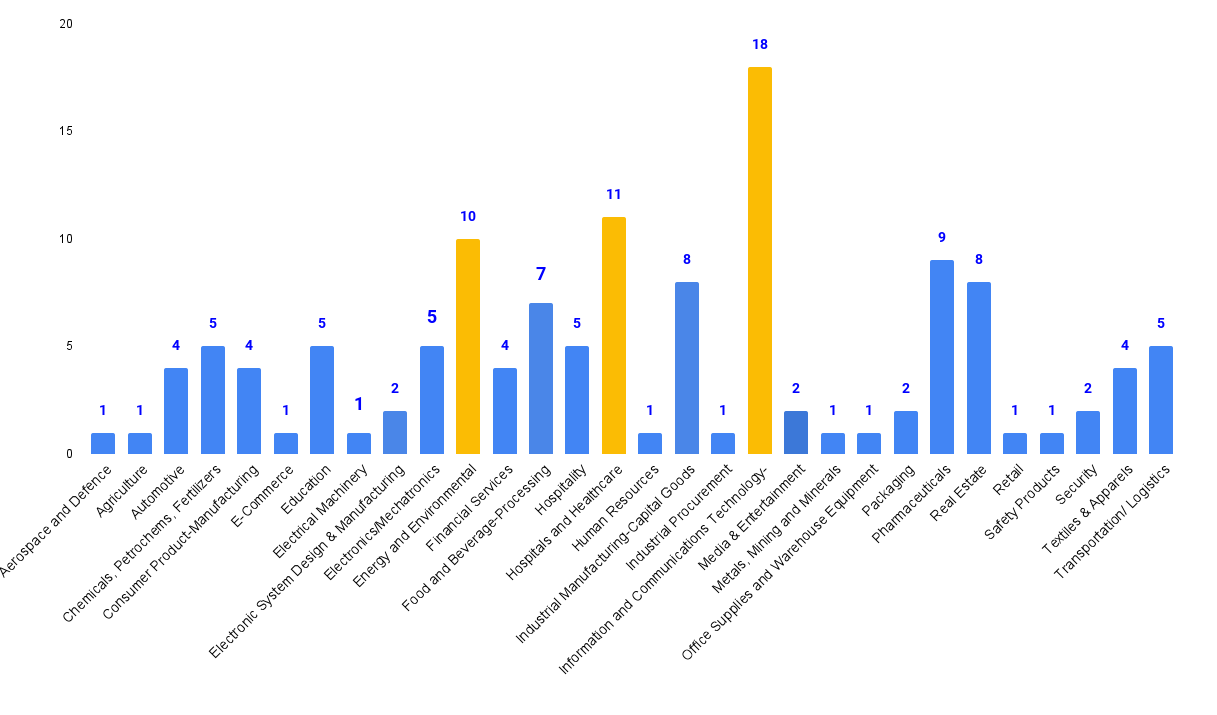

During the year, we added 560+ B2B clients including 200+ corporates, 224 investment bankers and 25+ Private Equity firms. The next year we will be intensifying India M&A picture and expanding in South East Asia and GCC regions to provide Inbound Capital access Indian businesses.

With announcements of Auto Ancillary & Pharmaceutical M&A deals through MergerDomo round the corner, we are excited to welcome 2023 keeping our Mission of helping SMEs in their Organic/Inorganic growth right at the forefront!

Connect with registered IBs who can connect you with the right prospects for your mandates.

Connect with corporates registered on the platform looking for acquisition targets.

Leverage MD relationships with associations and databases more than 10,000 companies with end-to-end cold outreach management.

|

Sector

|

Description

|

Deal Size

(INR Cr) |

Link

|

|---|---|---|---|

|

Education

|

An Education (Elementary and Secondary Schools (K 12)) entity from India is looking to sell out

|

200-210

|

|

|

Electronics/Mechatronics

|

An Electronics/Mechatronics (Industrial Electronics) entity from India is looking to sell out

|

70-75

|

|

|

Hospitality

|

A Hospitality (Hotels) entity from India is looking to sell out

|

95-100

|

|

|

Hospitals and Healthcare

|

A Hospitals and Healthcare (Diagnostic Imaging Centres) entity from India is looking to sell out

|

315

|

|

|

Hospitals and Healthcare

|

A Hospital and Healthcare (Medical College and Hospital) entity from India is looking to sell out

|

690

|

|

|

Hospitals and Healthcare

|

A Hospitals and Healthcare (Latex gloves) entity from India is looking to sell out

|

200-220

|

|

|

Industrial Manufacturing-Capital Goods

|

An Industrial Manufacturing-Capital Goods (Industrial Equipment and Assembly Machinery) entity from India is looking to sell out

|

120-140

|

|

|

Industrial Manufacturing-Capital Goods

|

An Industrial Manufacturing-Capital Goods (Injection molding) entity from India is looking to sell out

|

75-80

|

|

|

Information and Communications Technology-ICT

|

An Information and Communications Technology-ICT (IT Consulting) entity from India is looking to sell out

|

125

|

|

|

Information and Communications Technology-ICT

|

An Information and Communications Technology-ICT (IT Infrastructure Management) entity from India is looking to sell out

|

100-150

|

| Sector | Education |

|---|---|

| Description | An Education (Elementary and Secondary Schools (K 12)) entity from India is looking to sell out |

| Deal Size (INR Cr) | 200-210 |

| View Deal | |

| Sector | Electronics/Mechatronics |

|---|---|

| Description | An Electronics/Mechatronics (Industrial Electronics) entity from India is looking to sell out |

| Deal Size (INR Cr) | 70-75 |

| View Deal | |

| Sector | Hospitality |

|---|---|

| Description | A Hospitality (Hotels) entity from India is looking to sell out |

| Deal Size (INR Cr) | 95-100 |

| View Deal | |

| Sector | Hospitals and Healthcare |

|---|---|

| Description | A Hospitals and Healthcare (Diagnostic Imaging Centres) entity from India is looking to sell out |

| Deal Size (INR Cr) | 315 |

| View Deal | |

| Sector | Hospitals and Healthcare |

|---|---|

| Description | A Hospital and Healthcare (Medical College and Hospital) entity from India is looking to sell out |

| Deal Size (INR Cr) | 690 |

| View Deal | |

| Sector | Hospitals and Healthcare |

|---|---|

| Description | A Hospitals and Healthcare (Latex gloves) entity from India is looking to sell out |

| Deal Size (INR Cr) | 200-220 |

| View Deal | |

| Sector | Industrial Manufacturing-Capital Goods |

|---|---|

| Description | An Industrial Manufacturing-Capital Goods (Industrial Equipment and Assembly Machinery) entity from India is looking to sell out |

| Deal Size (INR Cr) | 120-140 |

| View Deal | |

| Sector | Industrial Manufacturing-Capital Goods |

|---|---|

| Description | An Industrial Manufacturing-Capital Goods (Injection molding) entity from India is looking to sell out |

| Deal Size (INR Cr) | 75-80 |

| View Deal | |

| Sector | Information and Communications Technology-ICT |

|---|---|

| Description | An Information and Communications Technology-ICT (IT Consulting) entity from India is looking to sell out |

| Deal Size (INR Cr) | 125 |

| View Deal | |

| Sector | Information and Communications Technology-ICT |

|---|---|

| Description | An Information and Communications Technology-ICT (IT Infrastructure Management) entity from India is looking to sell out |

| Deal Size (INR Cr) | 100-150 |

| View Deal | |

|

Sector

|

Description

|

Deal Size

(INR Cr) |

Link

|

|---|---|---|---|

|

Chemicals, Petrochems, Fertilizers

|

A Chemicals, Petrochems, Fertilizers (Petrochemicals) entity from India is looking for strategic investment opportunities in India

|

100-150

|

|

|

Electronics/Mechatronics

|

A B2B E-Commerce Unicorn from India is looking for strategic investment opportunities in Electronic components Companies in India

|

60-900

|

|

|

Food and Beverage-Processing

|

A Food and Beverage-Processing (Packaged food, aerated soft drinks and drinking water) entity from India is looking for strategic investment opportunities in India

|

100

|

|

|

Hospitality

|

A Hospitality (Hotels) entity from India is looking for strategic investment opportunities in India

|

200-300

|

|

|

Hospitals and Healthcare

|

A Hospitals and Healthcare (Diagnostic Imaging Centers) entity from India is looking for strategic investment opportunities in India

|

113

|

|

|

Industrial Manufacturing-Capital Goods

|

A B2B E-Commerce Unicorn from India is looking for strategic investment opportunities in Industrial Manufacturing-Capital Goods (Tools) sector in India

|

50-1100

|

|

|

Information and Communications Technology-ICT

|

An Information and Communications Technology-ICT (IT Infrastructure Management) entity from India is looking for strategic investment opportunities in India

|

50-300

|

|

|

Packaging

|

A B2B E-Commerce Unicorn from India is looking for strategic investment opportunities in Packaging (Packaging Manufacturers and Raw Material providers) sector in India

|

20-300

|

|

|

Pharmaceuticals

|

A Pharmaceuticals(Bulk Drug & API manufacturing) entity from India is looking for strategic investment opportunities in Pharmaceuticals (Veterinary Drugs) in India

|

50-200

|

|

|

Security

|

A B2B E-Commerce Unicorn from India is looking for strategic investment opportunities in Security (Industrial Security) sector in India

|

20-500

|

| Sector | Chemicals, Petrochems, Fertilizers |

|---|---|

| Description | A Chemicals, Petrochems, Fertilizers (Petrochemicals) entity from India is looking for strategic investment opportunities in India |

| Deal Size (INR Cr) | 100-500 |

| View Deal | |

| Sector | Electronics/Mechatronics |

|---|---|

| Description | A B2B E-Commerce Unicorn from India is looking for strategic investment opportunities in Electronic components Companies in India |

| Deal Size (INR Cr) | 60-900 |

| View Deal | |

| Sector | Food and Beverage-Processing |

|---|---|

| Description | A Food and Beverage-Processing (Packaged food, aerated soft drinks and drinking water) entity from India is looking for strategic investment opportunities in India |

| Deal Size (INR Cr) | 100 |

| View Deal | |

| Sector | Hospitality |

|---|---|

| Description | A Hospitality (Hotels) entity from India is looking for strategic investment opportunities in India |

| Deal Size (INR Cr) | 200-300 |

| View Deal | |

| Sector | Hospitals and Healthcare |

|---|---|

| Description | A Hospitals and Healthcare (Diagnostic Imaging Centers) entity from India is looking for strategic investment opportunities in India |

| Deal Size (INR Cr) | 113 |

| View Deal | |

| Sector | Industrial Manufacturing-Capital Goods |

|---|---|

| Description | A B2B E-Commerce Unicorn from India is looking for strategic investment opportunities in Industrial Manufacturing-Capital Goods (Tools) sector in India |

| Deal Size (INR Cr) | 50-1100 |

| View Deal | |

| Sector | Information and Communications Technology-ICT |

|---|---|

| Description | An Information and Communications Technology-ICT (IT Infrastructure Management) entity from India is looking for strategic investment opportunities in India |

| Deal Size (INR Cr) | 50-300 |

| View Deal | |

| Sector | Packaging |

|---|---|

| Description | A B2B E-Commerce Unicorn from India is looking for strategic investment opportunities in Packaging (Packaging Manufacturers and Raw Material providers) sector in India |

| Deal Size (INR Cr) | 20-300 |

| View Deal | |

| Sector | Pharmaceuticals |

|---|---|

| Description | A Pharmaceuticals(Bulk Drug & API manufacturing) entity from India is looking for strategic investment opportunities in Pharmaceuticals (Veterinary Drugs) in India |

| Deal Size (INR Cr) | 50-200 |

| View Deal | |

| Sector | Security |

|---|---|

| Description | A B2B E-Commerce Unicorn from India is looking for strategic investment opportunities in Security (Industrial Security) sector in India |

| Deal Size (INR Cr) | 20-500 |

| View Deal | |

Disclaimer: Any information provided herein is indicative only, subject to change without notice, and does not constitute an offer to purchase or sell. The information contained in this electronic message and in any attachments to this message is confidential, legally privileged, and intended only for the person or entity to which this electronic message is addressed. If you are not the intended recipient, please notify the system manager, and you are hereby notified that any distribution, copying, review, retransmission, dissemination, or other use of this electronic transmission or the information contained in it is strictly prohibited.