Posted on June 28, 2025 by MergerDomo

How M&A Deals Can Be Evaluated Like a Pro with Financial models

With the help of Financial Models numbers

are the best guide in the field of Mergers and Acquisitions (M&A). A

properly built financial model is a much needed tool by any one interested in a

deal, whether the buyer or the seller or the investor. These models provide

profound analysis of the financial status of the company and how it has

prospects to grow in the future.

Why Financial Models are Necessary in

M&A?

Rational decisions in M&A activities

are founded on financial models. This is the way they assist in every stage of

a transaction:

Target valuation: The financial model provides the systemized method to assess the

value of a company on how much the company is going to earn, what expenses it

will incur and what kind of profitability it will have under the specified

period of time. It assists purchasers and investors to evaluate the

reasonableness of the pricing being offered and whether the transaction would

fit into their bigger financial interests.

Due Diligence: Financial models will make it very easy to examine important

factors of such as cash flows, profit margins, and debt obligations very

carefully during the due diligence phase. This makes it possible to detect such

problems as overstated profit, concealed financial risks, or too high

estimations as soon as possible.

Negotiation Tool: These models have a solid basis in presenting a negotiating case by

presenting objective financial information. They can use them to justify their

stand regarding value, terms of payment or structure of a deal.

Decision Making: Financial models assist stakeholders to compare alternative courses

of action- which may either be to acquire a competitor, to raise capital or to

sell off business component. They give scope to a thorough evaluation of the

possible risks involved and how worthwhile are the projected returns to pursue

the transaction.

Important Financial Model constituents

of a M&A

The projection of Income Statement: These forecasts show supposed revenue, operating expenses and net

income in a time frame that could enable investors to see the harmony of

profitability of the company.

Balance Sheet: It gives an overview of the financial position of the firm since it

indicates the assets, liabilities, and shareholders equity of a firm at a given

time.

Cash Flow Forecasting: This aspect of the model assesses the ability to raise sufficient cash to finance the business, pay the debt re-payments and invest in the growth of the business.

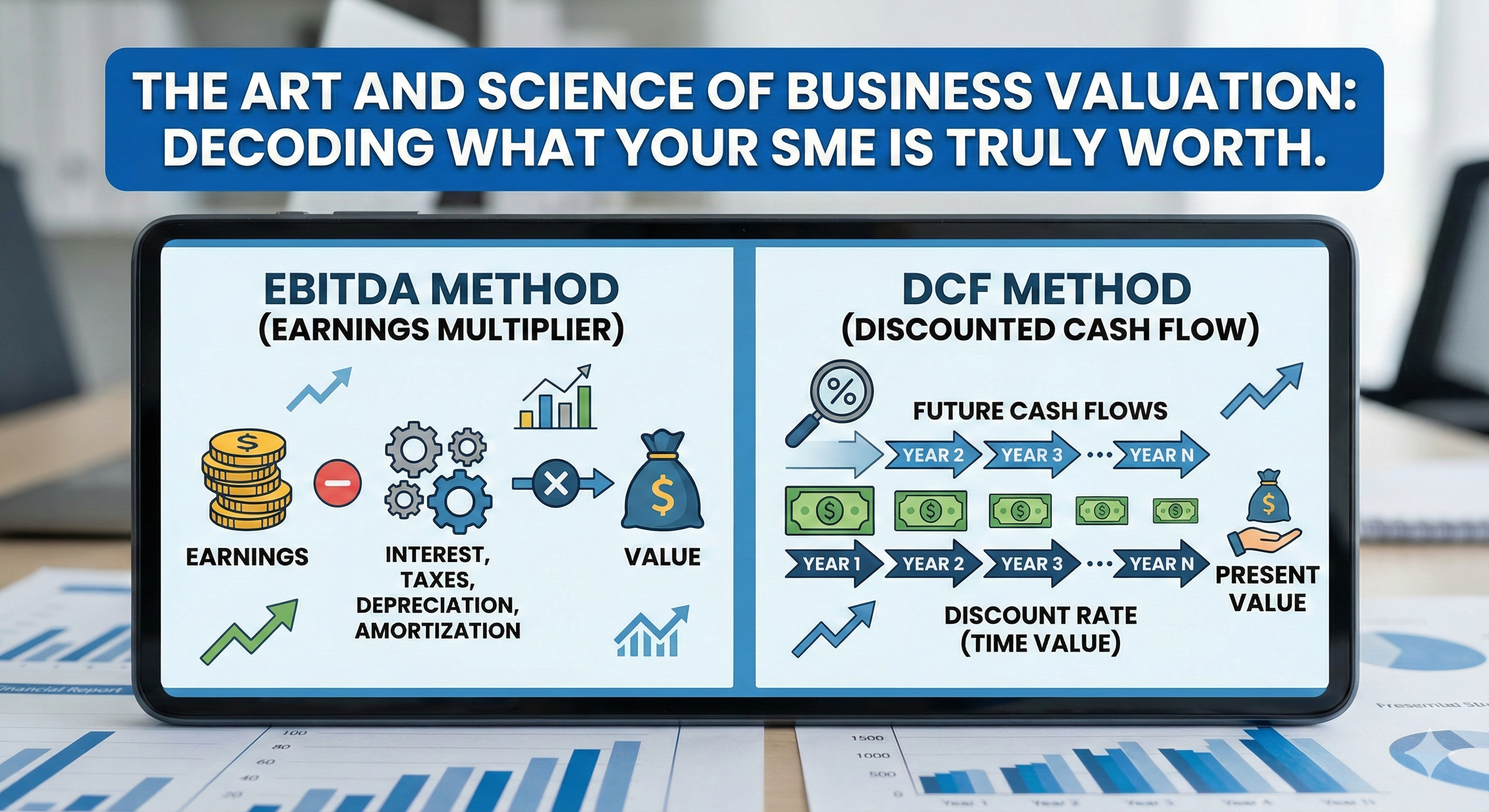

Discounted Cash Flow (DCF): DCF analysis enables

calculating the present value of the future cash flows of a business and their

correction with time and risk. It is a crucial methodology to realize long term

value.

Synergies and Cost Savings: The profitability of the merged organization can also be foreseen

by predictive models on the potential synergies created by a merger that could

result to reduced costs or increase in revenues.

How MergerDomo helps you with your

M&A Process-

MergerDomo makes financial modeling easier

among investors, corporates, and investment professionals. With our AI-powered

products you can easily make accurate and investor-ready models that are based

on real-world market information.

With MergerDomo: You receive information on

valuation which is based on credible market facts. We offer the Financial

Modeling and Valuation Tools that allow you to produce custom report forms of

stakeholders. It is time to get started on creating better M&A deals now.

Want to look into your next M&A deal

with clarity and confidence? MergerDomo provides the capability to create

powerful, data-driven financial models that provides structure and precision to

the most complex transactions.