Posted on May 24, 2025 by MergerDomo

The Basics of Business Valuation: Key Concepts Every Investor Should Know

It is important in M&A to use business valuation to guide your investment choices. Both new and skilled investors can profit a lot by learning how to calculate the true value of a business. In this article, we’ll guide you through the main valuation approaches and ideas every investor should understand.

Why is it

useful to know the value of a business?

It’s not only meant to figure out the price of a company. Its importance is in seeing how much the company is really worth, figuring out what risks and opportunities exist and deciding if you want to invest, liquidate or purchase again.

- Being able to properly determine a company’s value will give you the ability to:

- Use reliable data to guide all your business choices.

- Learn about the rewards you can expect from your investment.

- Don’t buy a business for more than it is truly worth or set its future goals too low.

The

Important Methods for Calculating a Company’s Value

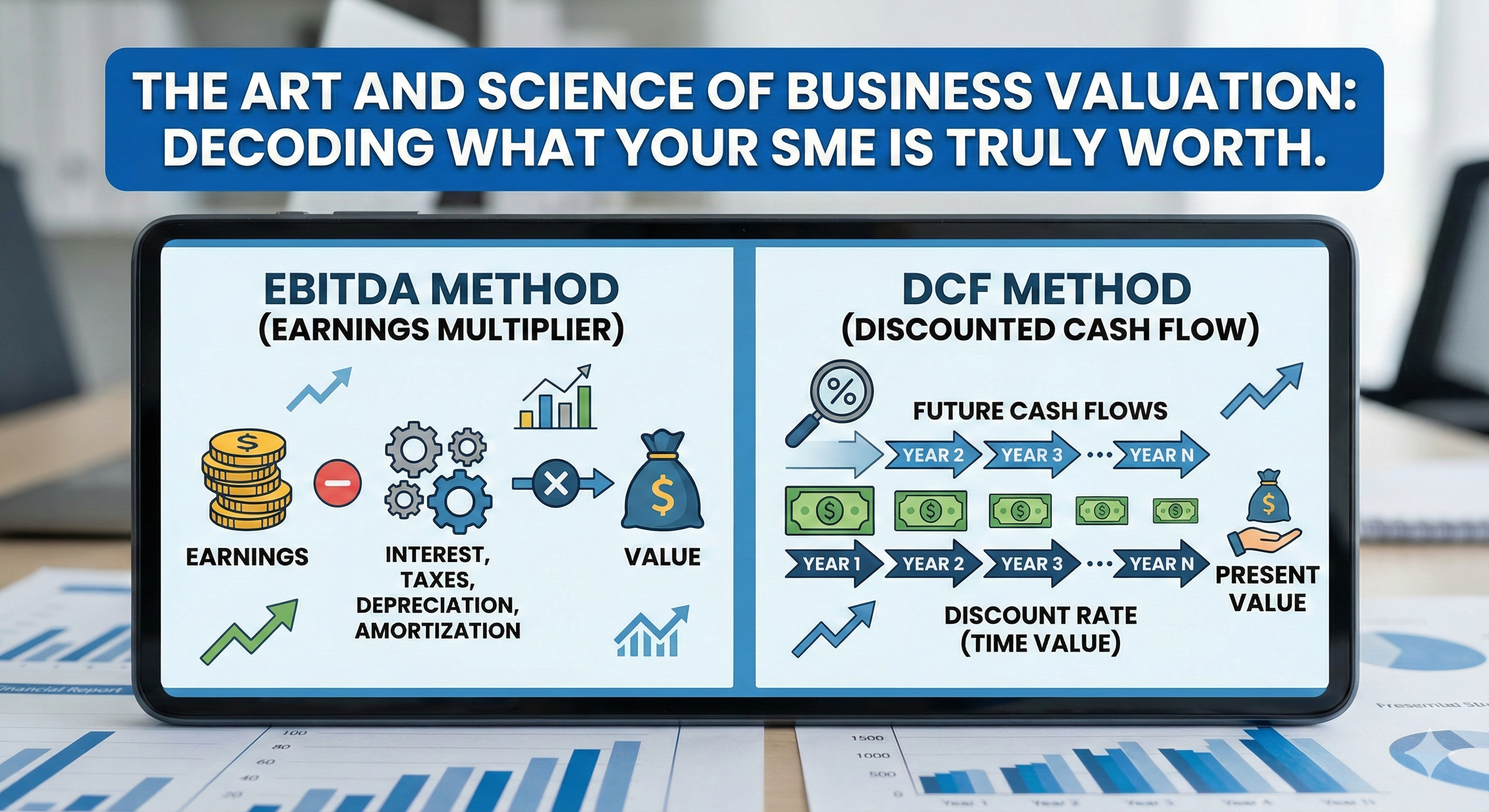

1) One of the best ways to estimate a company’s value is by

using Discounted Cash Flow (DCF) Analysis: It includes calculating the

company’s future cash flows and converting them to their current value. It

calculates the future profits of a company and adjusts them into current value,

using a discount rate.

- An advantage of this is that it has value based on what the

company expects to earn in the future.

- Disadvantages: Valuations can be wrong if the assumptions

used for growth and a discount rate aren’t carefully estimated.

2) Comparable Company Analysis (CCA): This method requires looking at a target

company’s results against those of comparable firms in that industry. For

comparison, we look at multiples such as the P/E ratio as well as EV/EBITDA and

others.

- Positives: Allows value to be linked to how market value is

determined for businesses.

- One problem is that you need to find companies that are

really alike which can be hard at times.

3) Precedent Transaction Analysis: Information

from those transactions such as the sales price and various valuation

multiples, is analyzed to determine how much the business is worth.

- Plus: Its numbers come from common market transactions,

making it a true measure for the market.

- Deals may differ due to things like when the transaction

takes place, the state of the market and the size of the company.

Important

Methods of Valuing Companies

- Enterprise Value (EV) takes into account

all the company’s debt and shows the company value minus its cash. It reflects

every aspect of the company’s total worth.

- EBITDA measures a company’s operating

profit and is usually the first step in valuing companies during M&A. The

approach helps eliminate differences caused by finance and accounting policies

when you check businesses from different industries.

- The DCF model depends on the discount rate

to correct the cash flows you expect to receive in the future. In it, the time

value of money is considered, along with the added risk of investing in the

company.

Signs to

Avoid

As you are assessing a company, pay attention to these

factors that might mean the business is facing risk:

- · When revenue or profit figures show up

irregularly, sometimes it means there are issues.

- · Unrealistic growth targets: If the company says

it will grow quickly, verify that there’s a good basis for their estimate.

- · If an enterprise’s multiples exceed the norm for

the industry, it probably deserves a lower price.

Conclusion

Any M&A investor needs to be skilled at business

valuation. Ensuring your financial goals are met starts with learning these

basic ways to value a business, whether you buy or invest in one.

At MergerDomo, we provide a variety of resources to evaluate

a company’s value such as our Valuation Tool, M&A Deal Summary Generator

and expert financial advice. Utilize these resources now to improve the way you

make investment choices.