Posted on July 26, 2025 by MergerDomo

The Role of Intellectual Property in M&A Deals

Intellectual property (IP) holds the key in determining the value and strategic alignment, as well as future promises for the company in mergers and acquisitions (M&A). IP assets such as patents, trademarks, and copyrights, as well as trade secrets, represent a major chunk of a firm's value, particularly in industries relating to technology and science or companies that rely on proprietary inventions.

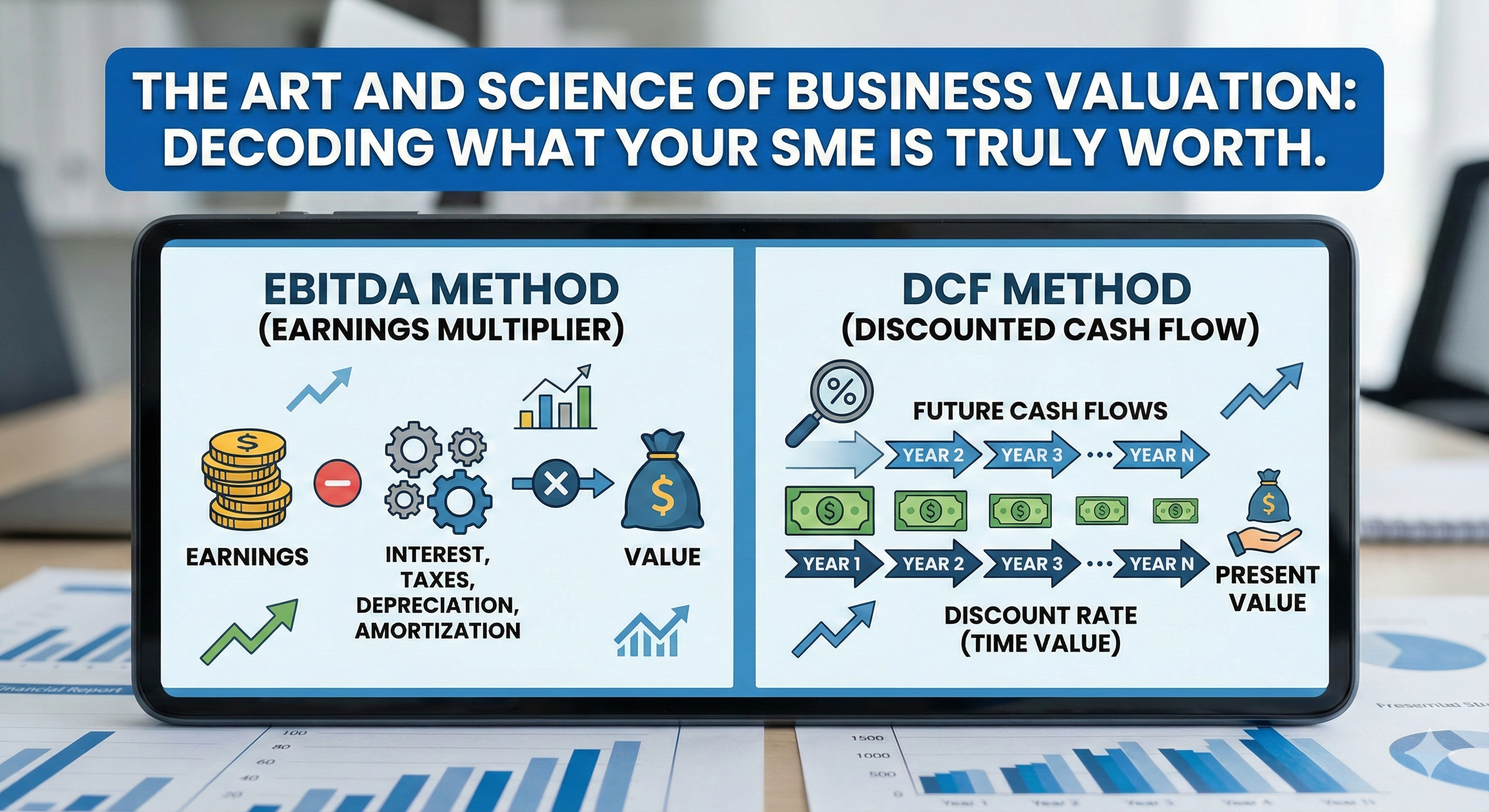

Valuation and Due Diligence:

In due diligence, IP is carefully assessed to identify its ownership, scope, and possible extent for commercialization. A diligent review of IP rights also verifies the arrears, liabilities and roadblocks, such as unsettled conflicts, licensing issues, or potential infringements. This enables the buyer to set out a realistic value for the IP without any culpability. Valuation for IP also plays a salient role since it affects the entire acquisition cost as well as future revenue streams once it is procured.

Strategic Alignment:

The competitive advantage of a company is often determined by its IP assets. In an M&A transaction, the bidder has to make strategic decisions based on the alignment of the target company’s IP portfolio. A relevant study of product offerings, market positions or innovation capabilities is done by the acquirer. Thus, unbreakable IP assets are a major break for the acquirer in terms of a more attractive market position, entry barrier, or advantage in competitive industries.

Post-Transaction Integration

After an acquisition, managing IP rights, integrating with existing portfolios, and aligning innovation strategy are vital for long-term success. The most essential items while safeguarding acquired assets and increasing growth are proper understanding and effective protection of IP.

Hence, intellectual property is more than a component of a firm's asset base; it is a strategic weapon in M&A transactions that impacts the short-term value and long-term potential of a negotiation.