Posted on May 17, 2025 by MergerDomo

How to Spot the High-Value M&A Opportunities

Spotting High-Value M&A Opportunities: A Guide for Investors

Focusing on the mergers and acquisitions world (M&A), it is essential to spot high-value opportunities for long-term resultant gains in investments. Then, what is a high-value M&A opportunity? And how did you identify one?

These are crucial indicators that can make it easier for you to locate the high-value targets for M&A:

1. Strong Financial Performance

One of the fundamental aspects when evaluating an M&A possibility is financial health. Look for companies that show:

- Consistent Revenue Growth: Identify businesses that have demonstrated a continuous growth of their revenues for the past 3-5 years.

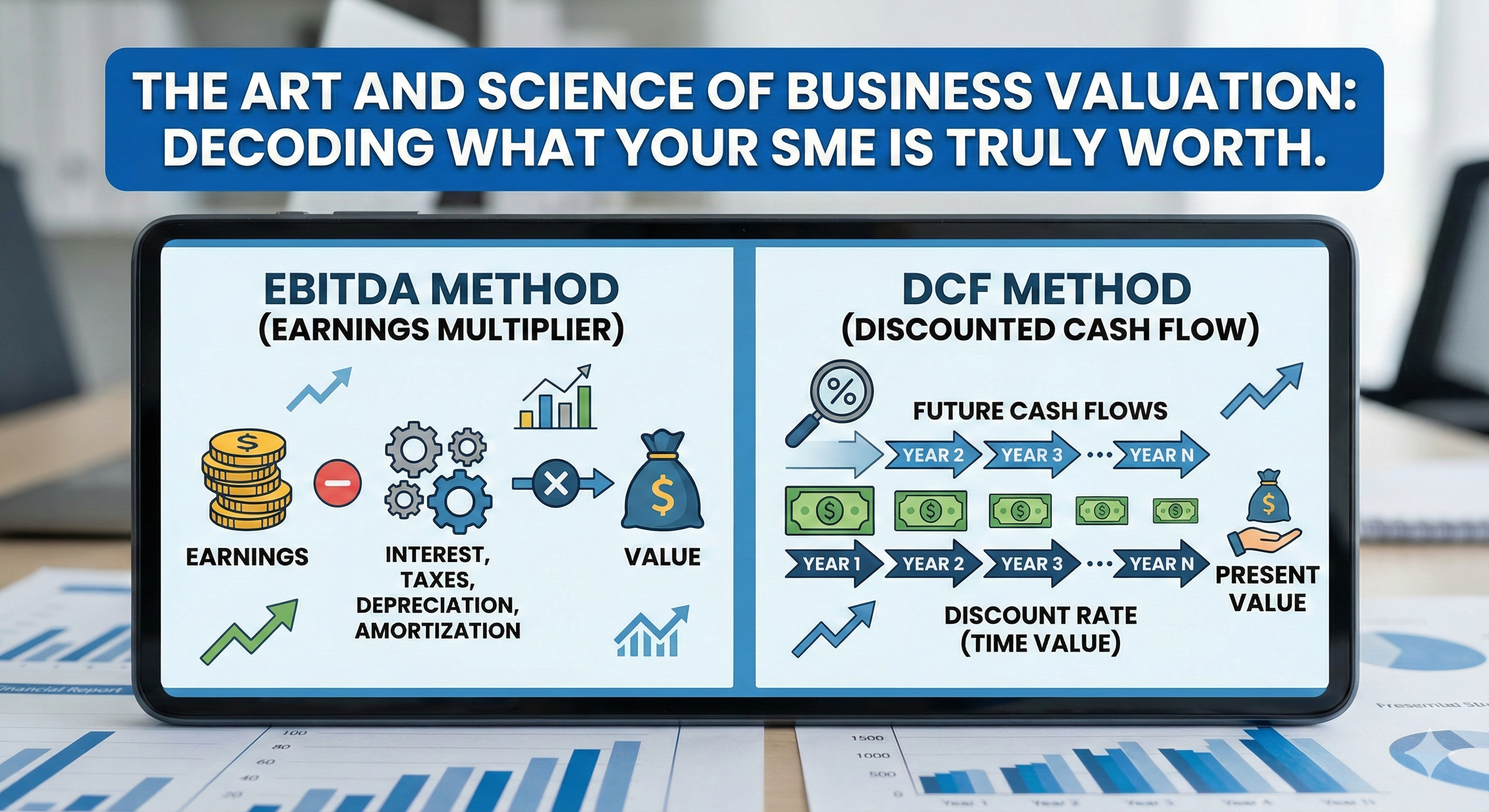

- Solid Profit Margins: High EBITDA margins and operating profit margins in companies are often indicative of efficiency as well as strength in operation.

- Free Cash Flow: Positive FCF shows the company is in position to finance expansion projects and cover debts.

2. Strategic Fit

An M&A opportunity that has a high value is usually going to work harmoniously within the strategic goals of the acquiring company. Look for:

- Synergies: Is the target company complementary or value-additive to your already existing business? It may be a chance to gain more market share, launch new products or explore new geographies.

- Competitive Position: A high value target most of the times will be in a vantage position within its market it has good customer base and barriers to competition.

3. Growth Potential

Selection of companies with the opportunity to scale up is the most important step in finding the high value targets for M&A:

- Market Expansion: Seek out organizations that are able easily to expand to new areas or branch out into new product lines.

- Innovation: As a rule, companies which invest in research and development have a strong potential for development especially in the industries-technology and biotech.

- Management Team: Having a visionary team of leaders can be one of the indicators that the firm is ready to grow for the long-term. Assess the record of the leadership team and how far they are with regards to company’s goals.

4. Favorable Valuation

The best companies will not be valuable if they are overvalued. In deliberation of potential M&A opportunities, make sure you:

- Use valuation multiples such as EV/EBITDA or P/E ratios to determine whether the target company is price adequately or not.

- Capital Asset Pricing Model (CAPM) background is necessary for forecasting future cash flows and arithmetically figuring out the real value of the concerned company.

5. Clean Books and Due Diligence

It is crucial to do due diligence where a lot of diligence is done. A high-value target will typically:

- Be clean in finances and have very minimal legal or operational issues.

- To be able to submit clear financial statements and evidence of position on the market that will not contain hidden threats and unresolved questions in relation to regulation.

Poised to find your next high-value M&A deal?

Implement these strategies from today to assess and spot high value M&A opportunities. If you get the tools and information you need, you can make informed choices that can put you in a good long-term position.

Interested in finding high-value deals? Visit the MergerDomo to find out what current M&A opportunities are available.