Posted on February 11, 2026 by MergerDomo

The Art and Science of Business Valuation: Decoding What Your SME is Truly Worth

Imagine you’ve spent twenty years building a boutique manufacturing firm in the heart of Pune or a tech-enabled logistics hub in Bengaluru. You’ve weathered the storms of market shifts, navigated the labyrinth of GST compliance, and built a team that feels like family. One day, an investor knocks, or perhaps you decide it’s time to hang up the boots and travel the world. The first question that hits the table isn’t "How much do you love this business?" It’s "What is the number?"

In the high-stakes world of Small and Medium Enterprises (SMEs), valuation is often treated like a dark art—a mysterious ritual performed by men in sharp suits using complex spreadsheets. But at MergerDomo, we believe valuation is less of a magic trick and more of a bridge between your past hard work and your future potential.

Whether you are looking to sell, raise funds, or simply benchmark your progress, understanding the "how" behind the "how much" is critical. Let’s pull back the curtain on the real formulas that move the needle.

Why Valuation is the "North Star" for SME Owners

Before we dive into the math, let’s talk about the why. For an SME owner, a valuation isn't just a vanity metric. It is your most powerful negotiating tool. Without a grounded valuation, you are flying blind. You might leave money on the table, or worse, scare away serious buyers with a "blue-sky" number that has no basis in reality.

In the current Indian economic climate, where the SME IPO market is buzzing and private equity is looking downstream for "hidden gems," having a professional valuation is the difference between a deal that closes and a deal that collapses.

1. The Asset-Based Approach: The "Floor" of Your Value

Think of this method as the "sum of its parts." It’s often the most straightforward approach, especially for businesses that are heavy on machinery, real estate, or inventory.

The Logic

If you were to close the doors today and sell everything—the laptops, the delivery trucks, the warehouse, and the patents—what would be left after paying off the bank? This is often referred to as the Net Asset Value (NAV) or Book Value.

The Formula: Net Asset Value (NAV)

$$Business Value = Total Assets - Total Liabilities$$

When to Use It

This is the "safety net" valuation. It’s particularly relevant for:

Manufacturing units with significant plant and machinery.

Distressed sales where the business isn't generating much profit but holds valuable real estate.

Investment holding companies.

The Human Angle: While this provides a solid floor, it often fails to capture the "secret sauce"—your brand reputation, customer loyalty, and the specialized knowledge of your workforce. It tells us what the business is, but not what it can do.

2. The Earnings-Based Approach: Capitalizing on the Future

Investors don't just buy what you own; they buy the right to your future cash flows. For most thriving SMEs, this is where the real value lies.

A. The Earnings Multiplier (Capitalization of Earnings)

This is the "shorthand" of the M&A world. It’s quick, it’s dirty, and it’s what most brokers will mention over a first cup of coffee.

The Formula

$$Business Value = Net Profit \times Multiplier$$

The "Multiplier" varies by industry. A stable grocery chain might have a multiplier of 3x, while a high-growth SaaS platform could command 10x or more.

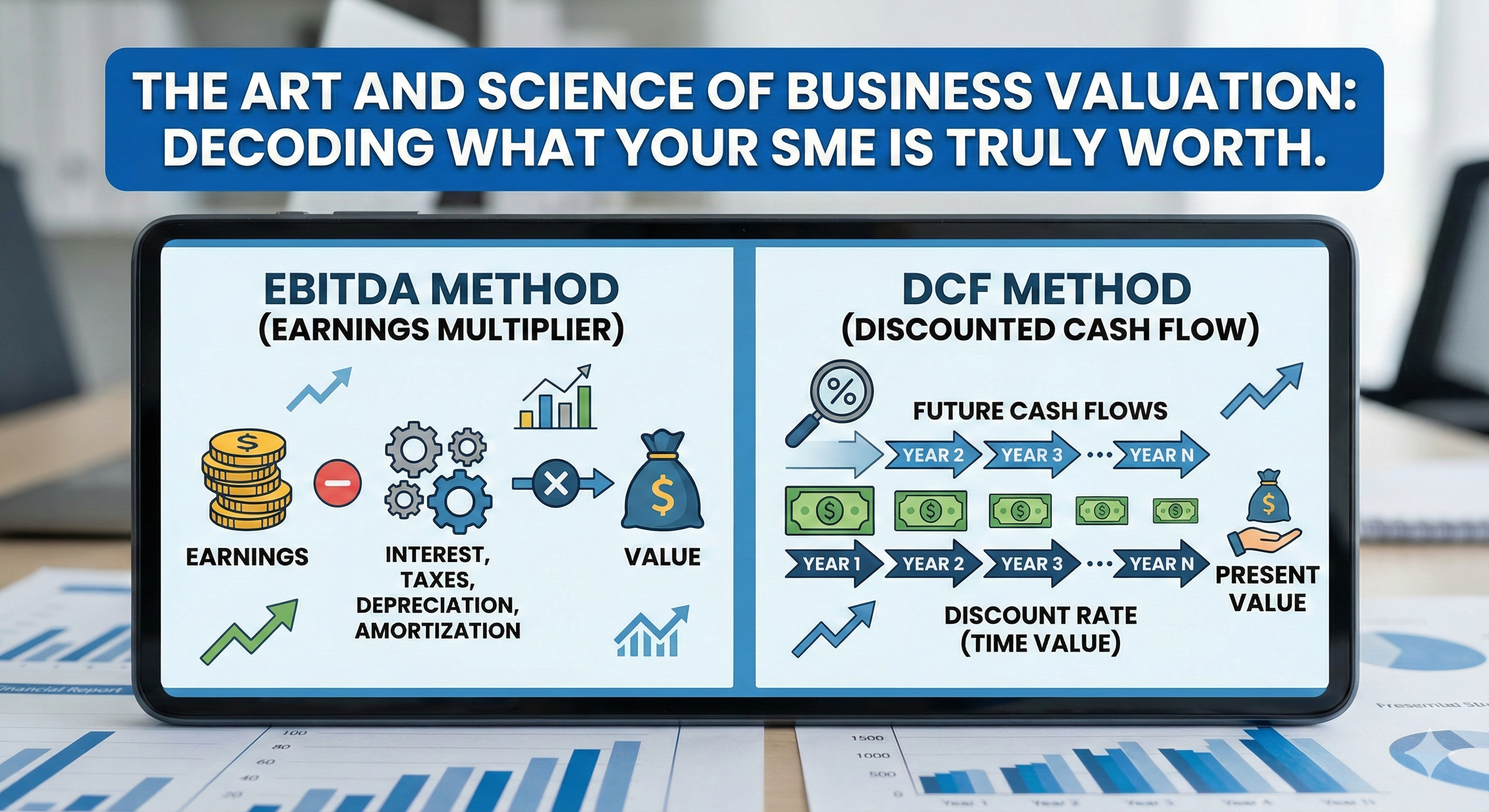

B. The EBITDA Method (The Gold Standard)

In the world of SME M&A, EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) is king. It represents the "operational" profitability of the business, stripped of accounting and financing choices.

The Formula

$$Enterprise Value = EBITDA \times Industry Multiple$$

Why it works: It allows an investor to compare a debt-free company with a debt-heavy company on an apples-to-apples basis.

3. Discounted Cash Flow (DCF): The "Crystal Ball" Method

If you want to build maximum authority in a boardroom, you bring a DCF analysis. It is the most mathematically rigorous way to value a business, focusing on the Time Value of Money.

The Logic

A rupee in your pocket today is worth more than a rupee promised five years from now. The DCF calculates the present value of all the cash your business will generate in the future.

The Formula

$$DCF = \sum \frac{CF_t}{(1+r)^t}$$

$CF_t$: Cash flow for a given year ($t$).

$r$: The discount rate (reflecting the risk and cost of capital).

$t$: The time period.

The Practical Tip

For SMEs, the "Terminal Value" (the value of the business beyond the projection period) often makes up 60-70% of the total DCF value. This highlights why long-term sustainability is more important than a one-year spike in sales.

4. Market Comparable Method: Keeping Up with the Neighbors

How much did the house down the street sell for? Real estate agents use "comps," and so do investment bankers.

The Logic

In a Relative Valuation, you look at recent M&A transactions of similar companies in your sector and region. This is often called Precedent Transaction Analysis.

The Formula (Simplified)

$$Your Value = (Peer Price / Peer Metric) \times Your Metric$$

(Where 'Metric' is usually Revenue or EBITDA)

The Nuance: No two SMEs are identical. You must adjust for size, geographic reach, and "Key Man Risk"—if the business can't run without the founder, a buyer will apply a heavy discount.

Case Study: The "Masala" of Valuation in Recent News

Look at the recent surge in the Indian D2C (Direct-to-Consumer) space. Many small spice and snack brands have been acquired by giants like Tata Consumer or ITC.

The Scenario: A home-grown snack brand in Gujarat with an EBITDA of ₹5 Crores might have been valued at 5x EBITDA (₹25 Crores) five years ago. However, because of their high digital footprint and loyal Gen-Z customer base, recent "market comps" show similar brands selling at Revenue Multiples of 3x or 4x. If their revenue is ₹40 Crores, their valuation jumps to ₹120-160 Crores!

The Lesson: The method you choose can change your life. Choosing a revenue-based multiple in a high-growth sector can unlock millions that an asset-based approach would miss.

Regional Spotlight: The "MSME" Push in India 2026

As of early 2026, the SME Chamber of India has been aggressively pushing for credit reforms, and the Rajasthan Industries and SME Summit recently highlighted the vision for "Viksit Bharat." These policy shifts make SME valuations more critical than ever.

With the government pushing for easier credit flow, having a "Bankable Valuation Report" is no longer optional—it's a prerequisite for competitive interest rates. In hubs like Mumbai, Chennai, and Delhi, we are seeing a "flight to quality," where transparent, well-valued businesses are attracting global "Dry Powder" (unallocated capital).

Common Pitfalls: Why Your Number Might Be Wrong

The "Sweat Equity" Trap: Thinking the hours you spent in the office translate directly to a higher price tag. Buyers care about results, not effort.

Ignoring Working Capital: A business with high revenue but all its cash tied up in unpaid invoices (high Debtors) is worth less than a cash-rich business.

The "Lumpiness" of SME Income: If 80% of your revenue comes from one client, a buyer will apply a heavy "Concentration Discount."

How to Boost Your Valuation Before You Sell

Clean Up the Books: Separation of personal and business expenses is the first thing a due diligence team looks for.

Institutionalize Knowledge: If you are the only one who knows the "secret recipe," you are a risk. Document your processes.

Diversify Your Client Base: Don't let one "whale" client dictate your company’s survival.

Invest in Technology: Even a traditional brick-and-mortar SME gets a "Tech Premium" if its operations are digitized.

The MergerDomo Advantage

At the end of the day, a formula is just a tool. It takes a craftsman to use it correctly. At MergerDomo, we combine these clinical financial models with deep "on-the-ground" empathy for the Indian entrepreneur. We don't just give you a number; we give you a strategy.

Are you curious about where your business stands in today’s market? Don’t rely on guesswork or "gut feelings" that might cost you crores.

Try our free valuation calculator

Get an instant, data-driven estimate of your business's worth and start your journey toward a successful exit or a massive fundraise.

https://www.mergerdomo.com/company-valuation

Take the Next Step

Whether you are ready to pass the baton or looking for the fuel to grow, MergerDomo is your partner in the trenches.

Sell your business: Find the exit you deserve.

Raise funds: Fuel your next chapter of growth.

Find buyers: Access a global network of strategic and financial investors.

Get expert consultation: Talk to professionals who understand the heartbeat of SMEs.

Visit us at www.mergerdomo.com and see how we can help you navigate the complex waters of M&A.

Merge better with MergerDomo.

Sources and Citations

MergerDomo Blog: "How to Value Your Business in India: 2025 Guide"

SME Chamber of India: News & Updates (January 2026)

ICSI Study Material: "Valuations & Business Modelling"

Valutico: "How to Value an SME—An Introductory Guide"

NISM: "Valuing a Company: Key Methods, Metrics & Investor Insights"