Posted on November 28, 2025 by MergerDomo

What Actually Happens in an M&A Deal? A Simple Breakdown for Founders

You think selling your business is simple, right? Agree on a price, sign some papers, get paid, and ride off into the sunset with a briefcase full of cash.

If only.

The reality of mergers and acquisitions is far more complex, far more time-consuming, and far more emotionally exhausting than most founders anticipate. The gap between "handshake agreement" and "money in the bank" is filled with due diligence nightmares, legal negotiations, and more paperwork than you ever imagined.

Let's break down what actually happens when you decide to sell your business from first contact to final closing.

Phase 1: The Courtship (AKA "Are We Doing This?")

Every M&A deal starts with what I call the courtship phase. This is where buyers and sellers circle each other, trying to gauge interest without revealing too much too soon. Here's how it typically unfolds:

A buyer expresses interest maybe through a broker, maybe directly, maybe through a mutual connection. You sign a Non-Disclosure Agreement (NDA) because nobody's sharing real numbers without legal protection. Then you provide some basic information: revenue, EBITDA, customer base, growth trajectory.

The buyer acts interested. You act casual. Both parties are playing it cool while internally freaking out.

What's really happening behind the scenes?

The buyer isn't just looking at your business. They're evaluating five to ten other acquisition targets simultaneously. You're in a competition you didn't even know you entered. Meanwhile, you're wondering if their initial valuation indication is fair or if you're being lowballed. You're probably also Googling "how to negotiate M&A deals" at 2 AM.

Why deals die here:

Most transactions never make it past this phase. Sellers oversell their business, presenting best-case scenarios as guaranteed outcomes. Buyers over-doubt everything, treating every claim with skepticism. The gap between perception and reality becomes too wide to bridge.

The key to surviving this phase?

Be honest. If your customer concentration is high, say so. If revenue is lumpy, explain why. Transparency now saves disaster later.

Phase 2: The Letter of Intent (Not Quite a Commitment)

If you survive the courtship, congratulations, you've reached the Letter of Intent (LOI) stage. The LOI is essentially a "let's get serious" document. The buyer puts their offer in writing, outlining:

Proposed purchase price (and how they calculated it)

Deal structure (all cash, stock, earnout, seller financing)

Key conditions (subject to due diligence, financing, regulatory approval)

Exclusivity period (usually 60-90 days where you can't shop the business to other buyers)

Timeline (when they expect to close)

Here's the catch that surprises most founders: the LOI is typically non-binding.

Either party can still walk away without legal consequences. The LOI is more of a framework for negotiation than an ironclad commitment. However, once you sign it, the clock starts ticking. The exclusivity clause means you're locked in, you can't take meetings with other potential buyers. You've committed to this process, even if the buyer hasn't fully committed to the deal.

What to watch for:

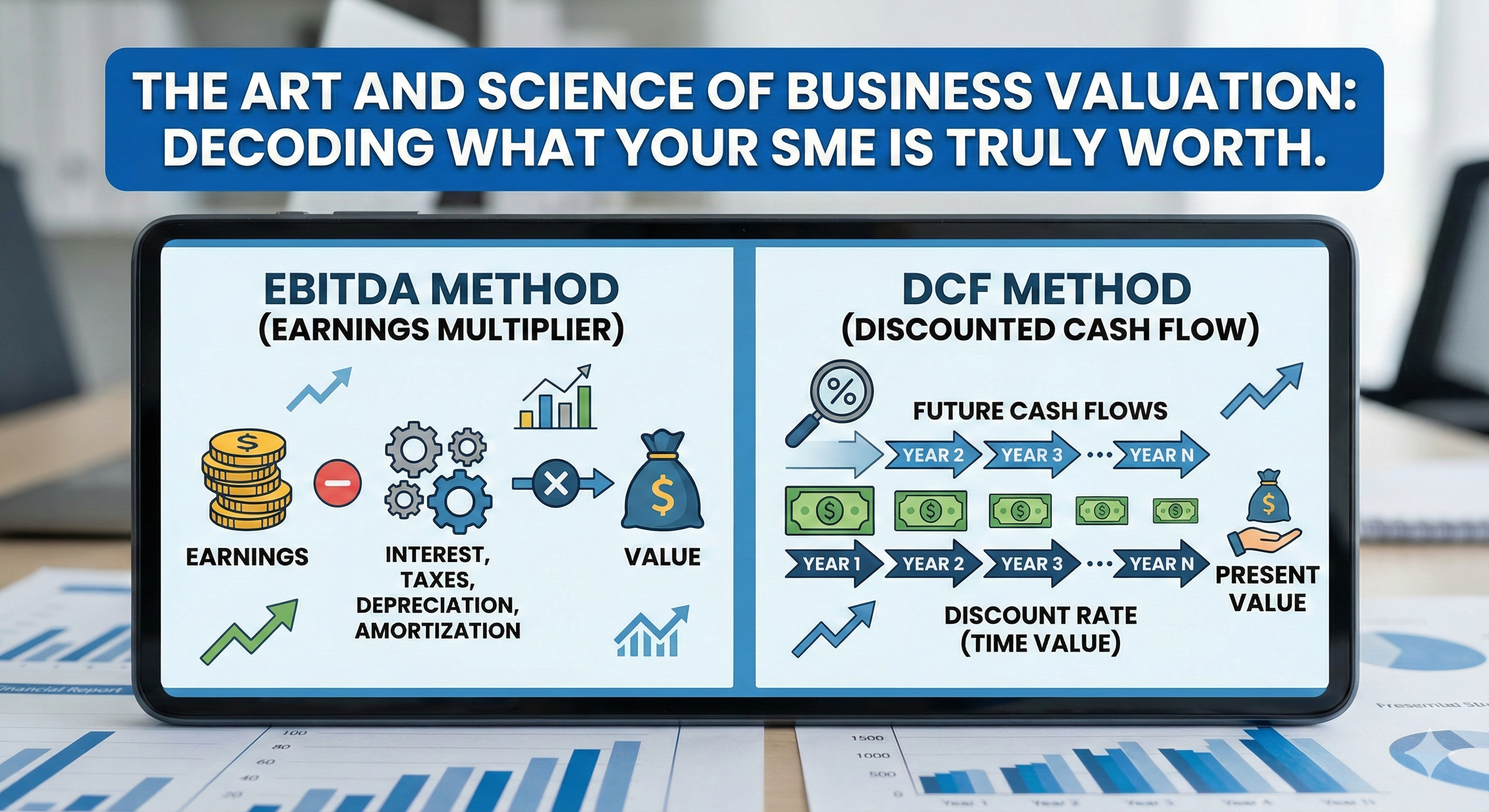

Pay close attention to the valuation methodology. Is it based on revenue multiples? EBITDA? Discounted cash flow? Understanding how they arrived at the number tells you how seriously they've evaluated your business. Also, scrutinize the earnout provisions if any exist. Earnouts mean a portion of your payment depends on future performance which you may or may not control after the acquisition.

Phase 3: Due Diligence (Where Deals Go to Die…)

Welcome to the most stressful 60-90 days of your entrepreneurial life. Due diligence is when the buyer audits absolutely everything about your business. And I mean everything.

Financial due diligence:

Every P&L statement for the past 3-5 years

Balance sheets, cash flow statements, tax returns

Accounts receivable aging reports

Capital expenditure records

That weird cash transaction from 2019 you forgot about

Legal due diligence:

Customer contracts and vendor agreements

Employment contracts and offer letters

Intellectual property registrations

Pending litigation or disputes

Compliance with regulations

Operational due diligence:

Customer concentration analysis

Revenue retention rates

Product roadmaps

Technology infrastructure

Key person dependencies

Commercial due diligence:

Market size and growth potential

Competitive landscape

Customer satisfaction and references

Sales pipeline validation

This is where skeletons come out of closets. And deals blow up.

Common deal-killers discovered during due diligence:

Customer concentration risk – One client represents 60% of revenue, and the buyer realizes the business is one cancellation away from collapse.

Founder dependency – The business can't operate without the founder, making it unsellable rather than valuable.

Questionable financials – Personal expenses mixed with business, aggressive revenue recognition, or "creative" accounting that doesn't hold up to scrutiny.

Undisclosed liabilities – Pending lawsuits, tax disputes, or warranty claims that weren't mentioned upfront.

Overstated projections – The growth forecast presented earlier has no supporting pipeline or data to back it up.

The brutal truth:

If something is going to kill your deal, it will surface during due diligence. This is why cleaning up your business before going to market is critical. Don't wait until a buyer is scrutinizing every detail to realize your books are a mess.

Phase 4: The Purchase Agreement (AKA The Lawyer Season)

You survived due diligence! The buyer still wants to move forward. Now comes the final purchase agreement, 47 pages of dense legalese that will make your head spin. This document finalizes every aspect of the transaction:

Purchase price adjustments: Working capital requirements, debt payoff, transaction expenses. The headline number in the LOI rarely equals the actual cash you receive. Representations and warranties: You're making legal promises about the state of the business. Revenue is accurate. You own your IP. There are no hidden liabilities. If these turn out to be false, you could be on the hook. Indemnification clauses: If something goes wrong after closing – a lawsuit emerges, a tax liability surfaces, a key contract gets cancelled – who pays for it? These clauses determine liability allocation. Escrow holdbacks: Typically 10-20% of the purchase price gets held in escrow for 12-18 months. If any issues arise during this period, the buyer can make claims against this money. Non-compete and non-solicitation: You're usually prevented from starting a competing business or poaching customers/employees for 2-5 years post-closing. Earnout provisions: If part of your payment is contingent on future performance, this section details the metrics, timelines, and calculation methodology.

This is where many founders realize they should have invested in better legal representation earlier. The difference between a well-negotiated purchase agreement and a poorly negotiated one can be millions of rupees.

Phase 5: Closing Day.

After months of negotiations, due diligence, and legal wrangling, you've reached closing day. Documents are signed. Wire transfers are executed. Ownership officially changes hands. Champagne is opened. But here's what nobody tells first-time sellers:

You don't get 100% of the money immediately.

Here's the typical breakdown:

60-70% paid at closing (minus transaction expenses, debt payoff, working capital adjustments)

10-20% held in escrow for 12-18 months (to cover potential indemnification claims)

10-30% tied to earnouts payable over 1-3 years if performance targets are met

So if you "sold" your business for ₹10 crore, you might only see ₹6 crore on day one. The rest comes later, if everything goes according to plan. Additionally, your involvement doesn't always end immediately.

Many deals include:

Transition services agreements where you stay on for 3-6 months to ensure smooth handover

Employment contracts where you become an employee of the acquiring company

Consulting arrangements where you remain available for strategic guidance

The Timeline Reality Check

From initial contact to final closing, M&A transactions typically take 6-12 months for middle-market deals. Sometimes longer if there are complications.

Typical timeline:

Courtship and initial discussions: 1-2 months

LOI negotiation: 2-4 weeks

Due diligence: 60-90 days

Purchase agreement negotiation: 30-60 days

Regulatory approvals and final closing: 30-60 days

And that's if everything goes smoothly, which it rarely does.

The Bottom Line

Selling your business isn't a simple transaction. It's a complex, emotionally draining process that requires preparation, patience, and professional guidance. The founders who get the best outcomes aren't necessarily those with the best businesses, they're the ones who understand the process, prepare their business for scrutiny, and surround themselves with experienced advisors.

Before you even think about selling:

✅ Clean up your financials and get them audit-ready.

✅ Reduce customer concentration risk.

✅ Document your operations so the business isn't dependent on you.

✅ Build systems that can transfer to new ownership.

✅ Understand your realistic valuation range.

Most founders have no idea what their business is actually worth or what buyers will scrutinize during due diligence.

Ready to understand your business value?

Try out our M&A scorecard that prepares you for deals:

👉 Comment "SCORECARD" to get the link.

Don't wait until you're negotiating to learn what matters.Because the best time to prepare for an exit isn't when you're negotiating, it's right now.

Get an edge over your business deals.

Merge better with MergerDomo.